We are very close to the end of Minor wave 2 up, with the top around a week in the future. Expectations for a three month long reprieve period were fulfilled as markets made a rapid bounce off the early October 2011 lows and then stayed elevated for the rest of the year. It was a chance for people to enjoy the holidays while the economic and financial fault lines in the western world were temporarily stabilized.

As we approach the end of the three month reprieve period, the mainstream media has become extremely bullish. Expectations for economists, market analysts, and journalists in the mainstream media to become very bullish on the economy, job market, and stock market by the end of the year have been fulfilled. Since the last write-up in early December 2011 as the last part of Minor wave 2 up started unfolding, people have become even more bullish on the economy, stock market, and job market.

Here are some recent examples of extreme bullishness that has shown up in the mainstream media in the last few days:

1 -- Yahoo news uses the rising consumer confidence as a reason to be bullish on the economy in 2012, even though the long term trend of lower highs and lower lows in consumer confidence since the peak in 2000 is still intact.

2 -- Journalists working for MSNBC are extremely bullish on the US economy, making calls for the economy and job market to grow faster in 2012. This bullishness is also shared by virtually all the mainstream economists as well, who are all calling for increased economic growth.

3 -- Douglas Kass (well known investor) is extremely bullish on the stock market, making bold calls for new all time highs by the end of 2012. The video of the interview on CNBC can be seen here.

4 -- On the Kudlow Report yesterday on CNBC, there was abundant talk about stocks being "ridiculously cheap", which indicates extreme bullishness. Video of the news segment is here.

From a socionomic perspective, extremes in social mood signal a reversal of the current trend. Combined with our current position of being near the end of Minor wave 2 up, there is a strong reason to anticipate an imminent reversal in the stock market.

The DJIA continues to follow the 1930s parallel with the third phase of "The Great Deflation" being a parallel of the Great Depression. Here are some updated charts of the DJIA underscoring the parallel:

DJIA in 1929 - 1930:

DJIA in 2009 - 2012:

Notice that both of the bear market rallies put in a head and shoulders top. In both cases, the head and shoulders top formed with fibonacci relationships in terms of time with a fibonacci convergence at the right shoulder.

In the bear market rally that unfolded in 1930:

1 -- The right shoulder peak formed 1.5 months (3 time units) after the peak of the head.

2 -- The peak of the head formed 2.5 months (5 time units) after the peak of the left shoulder.

3 -- The left shoulder and the right shoulder are 4 months (8 time units) apart.

4 -- The right shoulder peak formed 6.5 months (13 time units) after the start of the bear market rally in November 1929.

Notice the fibonacci sequence numbers 3 - 5 - 8 - 13 in the head and shoulders top.

In the bear market rally that unfolded in 2009 - 2012:

1 -- The right shoulder peaked 8 months after the head peaked.

2 -- The head peaked 13 months after the left shoulder peaked.

3 -- The left shoulder and the right shoulder are 21 months apart.

4 -- The right shoulder peaked 34 months after the start of the bear market rally.

Notice the fibonacci sequence numbers 8 - 13 - 21 - 34 in the head and shoulders top.

The sentiment in both of the bear market rallies is also identical as well. In both cases, economists, politicians, and the mainstream media were extremely bullish on the economy by the end of the bear market rally, with assurances from politicians and the mainstream media that the worst was over.

Here is a chart of the 1930 bear market rally with our current equivalent position arrowed on the chart:

We are currently at the equivalent of late May 1930. We are close to the end of Minor wave 2 up. After the reprieve period ends, Minor wave 3 down will start and is expected to take the form of a waterfall decline in the stock market with a duration of 4 months. The start of Minor wave 3 down is when the economy and stock market enters the heart of the abyss with "The Great Deflation" unfolding in full force, in the same way that the economy, stock market, and job market entered the heart of the abyss in early June 1930 during the Great Depression.

The downside target for the end of Minor wave 3 down is 7200 on the DJIA and 775 on the S&P 500, both to be reached in May 2012.

Wednesday, December 28, 2011

Wednesday, December 21, 2011

Precursors of the Great Tribulation Climax

The bear market is already bringing back the fear of a future conflict between the United States and Russia even as the climax of the tensions between the two countries is still over 40 years in the future. The precursors are currently small and trivial as we are still in the early part of the Grand Supercycle degree bear market.

After the Cold War ended in 1991, rising social mood had kept the tensions between the United States and Russia at bay. The Cold War started in 1946 in the immediate aftermath of World War II. The end of the Cold War corresponds with the beginning of Primary wave [5] of Cycle wave V (1974 - 2000) up in the S&5 500 index. Although the Cold War persisted for 45 years, the most significant events unfolded during the largest social mood declines:

1 -- Primary wave [2] of Cycle wave III (1942 - 1966) up is associated with the Berlin Blockade, the Marshall Plan, and the Czechoslovak coup d'etat.

2 -- Primary wave [4] of Cycle wave III (1942 - 1966) up is associated with the Cuban Missile Crisis.

3 -- Cycle wave IV (1966 - 1974) down is associated with the Prague Spring and the subsequent Warsaw Pact invasion of Czechoslovakia. A short time later, the Soviet Union introduced the Brezhnev Doctrine to justify putting an end to democratic liberalization efforts in the Eastern bloc.

4 -- Primary wave [2] of Cycle wave V (1974 - 2000) up is associated with the Soviet invasion of Afghanistan and the Reagan Doctrine in which Ronald Reagan labelled the Soviet Union as an "Evil Empire".

The Cold War also resulted in an arms race in which both the United States and the Soviet Union bolstered their nuclear weapons arsenals, and it resulted in a number of proxy wars in the third world.

The bear market is already bringing back the fear of a future conflict between the United States and Russia. The developments are trivial, but they likely foreshadow what is yet to come:

1 -- The popular video game Call of Duty : Modern Warfare 3 revolves around the story of an armed conflict between the United States and Russia in 2016 - 2017.

2 -- The movie Mission Impossible : Ghost Protocol also revolves around a conflict between the United States and Russia.

The United States is not the only country on the planet that is expanding its military-industrial complex. Russia is also modernizing its military capabilities as well, which could easily foreshadow future tensions between the United States and Russia in the future. The latest development is Russia working on a monster missile in response to US missile defense plans.

Bear markets of Supercycle degree and above always result in a war, an a 4000+ year historical perspective bears this out. Wars are associated with the largest "C" waves in a bear market, which in the case of the current bear market, would be "The Great Tribulation" (Supercycle wave (c)). The current bear market will result in World War III, which will start during Supercycle wave (c) of Grand Supercycle wave [IV]. During that time, both the United States and Russia will be in a state of war -- for the United States, it will be about the war on terror, for Russia, it will be about reclaiming lost territory and bringing back the Soviet Union and the Warsaw Pact. It is very likely that Iran will be the flash point that causes extreme tension between the two nations as Iran is allied with Russia.

It is perhaps very fortunate that the bear market isn't larger than Grand Supercycle degree. A Millennium degree bear market would have resulted in a limited nuclear exchange between the United States and Russia, with a 5 - 20 year nuclear winter to follow. A Super Millennium degree bear market would have resulted in a full scale nuclear exchange between the United States and Russia, causing a nuclear holocaust and a nuclear winter lasting 100+ years.

As "The Great Tribulation" reaches its climax, the bear market is expected to result in extreme tensions between the United States and Russia with the most dangerous game of chicken in the history of human civilization creating a global atmosphere of debilitating fear. The fear of an armed conflict will reach its climax in the 2052 - 2060 time frame as the bear market low point approaches. One can imagine the news in the mainstream media and the political world in 2055:

"A war between the United States and Russia is the harbinger of a new dark age for human civilization"

There will be a lot of tough talk, a lot of aggressive posturing, and a lot of saber rattling between the two nations during the last part of "The Great Tribulation", but no actual conflict is expected to take place.

After the Cold War ended in 1991, rising social mood had kept the tensions between the United States and Russia at bay. The Cold War started in 1946 in the immediate aftermath of World War II. The end of the Cold War corresponds with the beginning of Primary wave [5] of Cycle wave V (1974 - 2000) up in the S&5 500 index. Although the Cold War persisted for 45 years, the most significant events unfolded during the largest social mood declines:

1 -- Primary wave [2] of Cycle wave III (1942 - 1966) up is associated with the Berlin Blockade, the Marshall Plan, and the Czechoslovak coup d'etat.

2 -- Primary wave [4] of Cycle wave III (1942 - 1966) up is associated with the Cuban Missile Crisis.

3 -- Cycle wave IV (1966 - 1974) down is associated with the Prague Spring and the subsequent Warsaw Pact invasion of Czechoslovakia. A short time later, the Soviet Union introduced the Brezhnev Doctrine to justify putting an end to democratic liberalization efforts in the Eastern bloc.

4 -- Primary wave [2] of Cycle wave V (1974 - 2000) up is associated with the Soviet invasion of Afghanistan and the Reagan Doctrine in which Ronald Reagan labelled the Soviet Union as an "Evil Empire".

The Cold War also resulted in an arms race in which both the United States and the Soviet Union bolstered their nuclear weapons arsenals, and it resulted in a number of proxy wars in the third world.

The bear market is already bringing back the fear of a future conflict between the United States and Russia. The developments are trivial, but they likely foreshadow what is yet to come:

1 -- The popular video game Call of Duty : Modern Warfare 3 revolves around the story of an armed conflict between the United States and Russia in 2016 - 2017.

2 -- The movie Mission Impossible : Ghost Protocol also revolves around a conflict between the United States and Russia.

The United States is not the only country on the planet that is expanding its military-industrial complex. Russia is also modernizing its military capabilities as well, which could easily foreshadow future tensions between the United States and Russia in the future. The latest development is Russia working on a monster missile in response to US missile defense plans.

Bear markets of Supercycle degree and above always result in a war, an a 4000+ year historical perspective bears this out. Wars are associated with the largest "C" waves in a bear market, which in the case of the current bear market, would be "The Great Tribulation" (Supercycle wave (c)). The current bear market will result in World War III, which will start during Supercycle wave (c) of Grand Supercycle wave [IV]. During that time, both the United States and Russia will be in a state of war -- for the United States, it will be about the war on terror, for Russia, it will be about reclaiming lost territory and bringing back the Soviet Union and the Warsaw Pact. It is very likely that Iran will be the flash point that causes extreme tension between the two nations as Iran is allied with Russia.

It is perhaps very fortunate that the bear market isn't larger than Grand Supercycle degree. A Millennium degree bear market would have resulted in a limited nuclear exchange between the United States and Russia, with a 5 - 20 year nuclear winter to follow. A Super Millennium degree bear market would have resulted in a full scale nuclear exchange between the United States and Russia, causing a nuclear holocaust and a nuclear winter lasting 100+ years.

As "The Great Tribulation" reaches its climax, the bear market is expected to result in extreme tensions between the United States and Russia with the most dangerous game of chicken in the history of human civilization creating a global atmosphere of debilitating fear. The fear of an armed conflict will reach its climax in the 2052 - 2060 time frame as the bear market low point approaches. One can imagine the news in the mainstream media and the political world in 2055:

"A war between the United States and Russia is the harbinger of a new dark age for human civilization"

There will be a lot of tough talk, a lot of aggressive posturing, and a lot of saber rattling between the two nations during the last part of "The Great Tribulation", but no actual conflict is expected to take place.

Saturday, December 17, 2011

Increasing Political Gridlock Ahead

There existed the possibility that the Republicans and Democrats would briefly have a reluctant willingness to compromise during the last part of Minor wave 2 up as positive social mood results in compromise and consensus. We are indeed seeing a last willingness by Republicans and Democrats to compromise on government spending before "The Great Deflation" starts unfolding in full force.

It is significant that President Obama only managed to garner an agreement in Congress for a 2 month stopgap extension in extended unemployment benefits and a payroll tax cut in spite of over a month of hardcore campaigning on the payroll tax extension issue. This is in strong contrast to December 2010 where President Obama managed to hammer out an agreement for extended unemployment benefits and a payroll tax cut to be extended for a full year (all of 2011). The reason for the difference in outcome has to do with the social mood trends -- in December 2010, we were still in Primary wave [2] up, so the social mood at that time made it easier for President Obama to hammer out a deal with the GOP. We are now almost 8 months into Primary wave [3] down, and positive social mood at the peak of Minor wave 2 up (within a much larger Primary degree decline) was never going to achieve the lofty levels that were reached at the peak of Primary wave [2] up.

The difference in outcome between now and December 2010 underscores a fundamental aspect of bear markets -- as bearish social mood increases, so does strife and discord in the political arena, making it progressively harder for politicians to compromise and reach an agreement on various issues.

The next extension will go for a vote in Congress in late February 2012. By then, Minor wave 3 down will be well underway. Here is a chart of the DJIA with the events labelled:

When the next vote takes place, we will be in Minute wave [iii] of Minor wave 3 down with the Intermediate degree point of recognition close at hand. Given the bearish social mood that will be present at that time, there will be too much strife and discord to make any type of agreement possible, effectively putting an end to the payroll tax cuts and extended unemployment benefits on March 1, 2012. With Congress also due to hammer out a federal budget around that time as well, the strife and discord in the political arena due to bearish social mood will make a government shutdown with a duration of several months a virtual certainty as Republicans refuse to budge on protecting the tax cuts for the top 1% and Democrats refuse to budge on raising taxes on the top 1%.

With Minor wave 3 down on the horizon, one of the defining characteristics of 2012 will be increasing political gridlock as the Republicans and the Democrats become increasingly stubborn, ultimately resulting in a federal government shutdown lasting several months.

It is significant that President Obama only managed to garner an agreement in Congress for a 2 month stopgap extension in extended unemployment benefits and a payroll tax cut in spite of over a month of hardcore campaigning on the payroll tax extension issue. This is in strong contrast to December 2010 where President Obama managed to hammer out an agreement for extended unemployment benefits and a payroll tax cut to be extended for a full year (all of 2011). The reason for the difference in outcome has to do with the social mood trends -- in December 2010, we were still in Primary wave [2] up, so the social mood at that time made it easier for President Obama to hammer out a deal with the GOP. We are now almost 8 months into Primary wave [3] down, and positive social mood at the peak of Minor wave 2 up (within a much larger Primary degree decline) was never going to achieve the lofty levels that were reached at the peak of Primary wave [2] up.

The difference in outcome between now and December 2010 underscores a fundamental aspect of bear markets -- as bearish social mood increases, so does strife and discord in the political arena, making it progressively harder for politicians to compromise and reach an agreement on various issues.

The next extension will go for a vote in Congress in late February 2012. By then, Minor wave 3 down will be well underway. Here is a chart of the DJIA with the events labelled:

When the next vote takes place, we will be in Minute wave [iii] of Minor wave 3 down with the Intermediate degree point of recognition close at hand. Given the bearish social mood that will be present at that time, there will be too much strife and discord to make any type of agreement possible, effectively putting an end to the payroll tax cuts and extended unemployment benefits on March 1, 2012. With Congress also due to hammer out a federal budget around that time as well, the strife and discord in the political arena due to bearish social mood will make a government shutdown with a duration of several months a virtual certainty as Republicans refuse to budge on protecting the tax cuts for the top 1% and Democrats refuse to budge on raising taxes on the top 1%.

With Minor wave 3 down on the horizon, one of the defining characteristics of 2012 will be increasing political gridlock as the Republicans and the Democrats become increasingly stubborn, ultimately resulting in a federal government shutdown lasting several months.

Wednesday, December 14, 2011

US Dollar Index Hits 11 Month High

The US Dollar Index reached an 11 month high, breaking through the 80 barrier yesterday and staying above that level today. The bulls are in firm control over the dollar even as "The Great Deflation" inexorably regains the upper hand in gold, oil, stocks, and housing after a 2 year bear market rally from March 2009 to May 2011.

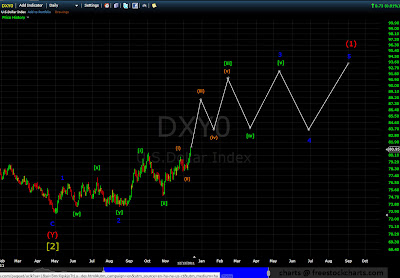

Here is an updated chart of the US Dollar Index starting from the low of Primary wave [2] down (2008 - 2011) and the rally so far from the low:

The primary count is that the dollar is approaching the center of Intermediate wave (1) of Primary wave [3] up, which could explain the break-out advance that has started to unfold over the last month. This scenario is hinting that we are close to reaching an Intermediate degree point of recognition in which analysts and economists will start to realize that the dollar is trending upwards.

Here is a chart of the US Dollar Index since the low in 2008, which shows part of a Cycle degree advance in progress:

The upside target of Intermediate wave (1) of Primary wave [3] in the US Dollar Index is around 93, to be reached in September 2012. The upside target takes the dollar beyond the peak of Primary wave [1] up.

Here is a chart of the US Dollar Index, showing the projected wave path of the dollar through the rest of "The Great Deflation". The advance from the low in 2008 is Cycle wave I up, projected to end in 2021 with an upside target of around 185.

The US Dollar Index is an important part of "The Great Deflation" picture. While the US Dollar Index is in a bullish uptend, stocks, commodities, the economy, and job market are declining during the same time interval. Here is how the dollar fits into the overall picture:

1 -- The Cycle degree advance in the dollar from 2008 to 2021 lasts a fibonacci 13 years. The advance was preceded by a 32 year bearish ending diagonal. The 13 year duration for Cycle wave I up in the dollar also fulfills the guideline that ending diagonals are retraced in the opposite direction in one-third to one-half of the time. This strongly argues for "The Great Deflation" ending in 2021. Cycle wave I up in the US Dollar Index strongly corresponds to Cycle wave c down in the DJIA, S&P 500 and the Wilshire 5000.

2 -- Most of the global debt is denominated in US dollars. During the massive credit bubble that unfolded during Cycle wave V up (1974 - 2000), the dollar was relentlessly devalued relative to other currencies on the planet as the credit bubble expanded. At the height of the credit bubble, there was an estimated 1 quadrillion (that is 10^15) dollars in debt throughout the globe. Now that the credit bubble is imploding, the US dollar is rising in value again as phantom money (which is mostly dollars) disappears into thin air.

As "The Great Deflation" starts unfolding in full force, the US Dollar Index will accelerate upwards. Primary wave [3] up in the US Dollar Index strongly corresponds to Primary wave [3] down in the DJIA, S&P 500, and the Wilshire 5000. As we are approaching the center of Intermediate wave (1) of Primary wave [3] up in the dollar, the overall sentiment on the dollar in the mainstream media is something to keep an eye on in the coming weeks.

Here is an updated chart of the US Dollar Index starting from the low of Primary wave [2] down (2008 - 2011) and the rally so far from the low:

The primary count is that the dollar is approaching the center of Intermediate wave (1) of Primary wave [3] up, which could explain the break-out advance that has started to unfold over the last month. This scenario is hinting that we are close to reaching an Intermediate degree point of recognition in which analysts and economists will start to realize that the dollar is trending upwards.

Here is a chart of the US Dollar Index since the low in 2008, which shows part of a Cycle degree advance in progress:

The upside target of Intermediate wave (1) of Primary wave [3] in the US Dollar Index is around 93, to be reached in September 2012. The upside target takes the dollar beyond the peak of Primary wave [1] up.

Here is a chart of the US Dollar Index, showing the projected wave path of the dollar through the rest of "The Great Deflation". The advance from the low in 2008 is Cycle wave I up, projected to end in 2021 with an upside target of around 185.

The US Dollar Index is an important part of "The Great Deflation" picture. While the US Dollar Index is in a bullish uptend, stocks, commodities, the economy, and job market are declining during the same time interval. Here is how the dollar fits into the overall picture:

1 -- The Cycle degree advance in the dollar from 2008 to 2021 lasts a fibonacci 13 years. The advance was preceded by a 32 year bearish ending diagonal. The 13 year duration for Cycle wave I up in the dollar also fulfills the guideline that ending diagonals are retraced in the opposite direction in one-third to one-half of the time. This strongly argues for "The Great Deflation" ending in 2021. Cycle wave I up in the US Dollar Index strongly corresponds to Cycle wave c down in the DJIA, S&P 500 and the Wilshire 5000.

2 -- Most of the global debt is denominated in US dollars. During the massive credit bubble that unfolded during Cycle wave V up (1974 - 2000), the dollar was relentlessly devalued relative to other currencies on the planet as the credit bubble expanded. At the height of the credit bubble, there was an estimated 1 quadrillion (that is 10^15) dollars in debt throughout the globe. Now that the credit bubble is imploding, the US dollar is rising in value again as phantom money (which is mostly dollars) disappears into thin air.

As "The Great Deflation" starts unfolding in full force, the US Dollar Index will accelerate upwards. Primary wave [3] up in the US Dollar Index strongly corresponds to Primary wave [3] down in the DJIA, S&P 500, and the Wilshire 5000. As we are approaching the center of Intermediate wave (1) of Primary wave [3] up in the dollar, the overall sentiment on the dollar in the mainstream media is something to keep an eye on in the coming weeks.

Thursday, December 8, 2011

Socionomic Perspective on the 2012 GOP Primary

As we approach the end of 2011, all eyes are on the 2012 GOP primary election. On the Democratic side, it is very obvious that Barack Obama will win the Democratic Primary in a massive landslide, as it is very unlikely within the next few weeks that a progressive candidate will come forward to initiate a primary challenge. The GOP Primary is another matter altogether as it is still in a state of flux although some inferences can be made using the socionomic model to predict how the GOP Primary elections and caucuses will progress.

Back in late 2009, Nate Silver did a write-up on the possibility of Sarah Palin winning the 2012 GOP Primary. The author correctly recognized that voter demographics present in each state has a significant influence on election results. There is, however, a very large caveat to the possible results of the 2012 GOP Primary -- the social mood of the United States population as a function of time. Social mood has a very strong influence on how people vote, as the vast majority of people vote with their limbic systems (the part of people's brains that induce herding behavior). In bull markets, there is an increasing tendency to vote for centrist candidates, while in bear markets, there is an increasing tendency to vote for radical candidates (especially after the early stages of a bear market of Cycle or larger degree). Factoring in the influence of social mood will give a better picture of how the 2012 GOP Primary is likely to progress.

Sarah Palin isn't in the 2012 GOP race. Of the GOP candidates that have a viable chance of getting the nomination, Mitt Romney is clearly a centrist candidate, Newt Gingrich and Ron Paul are semi-radical candidates, thus making them a decent proxy of Sarah Palin, while Michele Bachmann and Rick Perry are radical candidates, making them an excellent proxy of Sarah Palin.

Currently, we are in the early stages of Primary wave [3] down, just over 7 months so far out of a projected duration of 58 months. Even in 2012, as we go deeper into Primary wave [3] down, social mood may be too bullish for either Michele Bachmann or Rick Perry to with the GOP nomination. A more likely scenario as we go through the heart of Intermediate wave (1) of Primary wave [3] down, is that a semi-radical candidate will have a much better shot at the nomination -- which would favor Newt Gingrich and Ron Paul.

Here is a chart of the DJIA in 2012 with the 2012 GOP Primary elections labelled on the chart:

Here is a step by step walkthrough on how the 2012 GOP Primary could unfold:

Initial wave of states : Iowa, New Hampshire, South Carolina, Florida, and Nevada

Nate Silver rated Iowa and South Carolina as winnable for Sarah Palin, but also indicated that New Hampshire and Nevada would likely go to Mitt Romney.

Iowa is the first state to cast its vote in the 2012 GOP Primary. Iowa holds a caucus rather than a primary. The Iowa caucus takes place as we reach the peak of Minor wave 2 up. While Minor wave 2 up is unfolding, Mitt Romney will have the wind at his back. Although Iowa tends to turn out conservative voters in its caucus, Mitt Romney could perform surprisingly well with up to 25% of the vote. Look for Newt Gingrich, Ron Paul, and Mitt Romney to put in competitive numbers in the Iowa caucus with all three winning delegates.

New Hampshire is the second state in the GOP Primary. New Hampshire tends to favor centrist candidates, which will give Mitt Romney a substantial advantage. Minor wave 3 down will already be under way when New Hampshire holds its primary. However, Minor wave 3 down is expected to be in its early stages (about half way through Minute wave [i] of Minor wave 3 down) so Mitt Romney will still be able to win the state by a sizable margin even though he will no longer have the wind at his back.

South Carolina would be next after New Hampshire. South Carolina tends to favor conservative candidates. We will be almost a month into Minor wave 3 down with its first subwave almost completed when South Carolina holds its primary. Look for Mitt Romney to put in a weak performance with Newt Gingrich and Ron Paul each picking up 35% to 40% of the vote.

Florida holds its primary at the end of January 2012. Nate Silver rated Florida as below average for Sarah Palin, and its reasonable that it would be below average for Newt Gingrich and Ron Paul as well. We will have completed Minute wave [i] of Minor wave 3 down at this point, so a bearish social mood will almost certainly counter most of the advantage that Mitt Romney would otherwise have. Although Mitt Romney could win the state, look for Newt Gingrich and Ron Paul to put in competitive numbers.

Nevada is the last of the states in the early phase of the 2012 GOP Primary. Nevada plays very strongly to Mitt Romney's advantage. We will be in Minute wave [ii] of Minor wave 3 down. The rising social mood associated with Minute wave [ii] could (at least temporarily) give Mitt Romney a wind at his back. Look for Mitt Romney to win Nevada by a big margin.

Second wave of states -- Montana, Idaho, Wyoming, Alaska, Maine, Nebraska, North Dakota, South Dakota, New Mexico, Hawaii, Delaware, Rhode Island, Vermont, and West Virginia

Nate Silver's analysis back in 2009 indicated that if Sarah Palin can survive the initial wave of states, the second wave of states would be very strong for her. However, the second wave of states also tends to award organizational strength as well, which would be most advantageous to Mitt Romney. The 2012 GOP Primary should be a three man race at this point with Mitt Romney, Newt Gingrich, and Ron Paul vying for the nomination. We will be in the first half of Minute wave [iii] of Minor wave 3 down during this period. Mitt Romney should find success in the early part of this period, but success will get progressively more difficult as we approach the center of Minor wave 3 down. Look for Mitt Romney to win around a third of the states.

Super Tuesday -- Texas Group of states

The later wave of states unfold in three phases with Super Tuesday being the first phase, the second phase unfolding from late March 2012 to early May 2012, and the third phase from mid May 2012 to mid June 2012. The Texas group was rated as good for Sarah Palin's nomination chances (and thus would be an advantage to Newt Gingrich and Ron Paul as well) while the California group and the Pennsylvania group both confer an advantage to Mitt Romney under normal conditions.

By the time Super Tuesday comes around, we will have passed through the center of Minor wave 3 down, triggering an Intermediate degree point of recognition in a bear market. The result will be the "Panic of 2012" with the Obama Administration launching TARP 2 to bail out the banks. In the aftermath of the Intermediate degree point of recognition, the political winds will shift back in the direction of the Republicans, and even within the GOP, the political winds will shift strongly in favor of increasingly radical candidates. This is where Mitt Romney will reach the end of the road as a combination of bearish social mood and the Texas group being advantageous to conservatives will be too much to overcome. Expect Mitt Romney to drop out of the race in the aftermath of a painfully disappointing performance on Super Tuesday.

Pennsylvania Group of states

This phase of the 2012 GOP Primary will unfold during Minute waves [iv] and [v] of Minor wave 3 down. It will be a two man race at this point with Newt Gingrich and Ron Paul battling it out for the nomination. By the end of this period, it should be clear who the Republican nominee will be, depending on how evenly matched the two candidates are against each other

California Group of states

The last phase of the 2012 GOP Primary unfolds during Minor wave 4 up. If the two candidates are evenly matched against each other, we may get a scenario where nobody gets the required number of delegates needed to win the Republican nomination. Endorsements will be key in the last phase of the race if the contest is close.

We are currently in the final part of Minor wave 2 up. Mitt Romney will have the wind at his back for the rest of the year and for the first few days of January 2012. The mainstream media is already convinced that Mitt Romney will win the Republican nomination. By the end of Minor wave 2 up, Mitt Romney will have moved back into first place in all the polls. Once Minor wave 3 down starts unfolding, success will become increasingly difficult for Mitt Romney as the bearish social mood brings out the voter tendency to pick increasingly radical candidates.

Back in late 2009, Nate Silver did a write-up on the possibility of Sarah Palin winning the 2012 GOP Primary. The author correctly recognized that voter demographics present in each state has a significant influence on election results. There is, however, a very large caveat to the possible results of the 2012 GOP Primary -- the social mood of the United States population as a function of time. Social mood has a very strong influence on how people vote, as the vast majority of people vote with their limbic systems (the part of people's brains that induce herding behavior). In bull markets, there is an increasing tendency to vote for centrist candidates, while in bear markets, there is an increasing tendency to vote for radical candidates (especially after the early stages of a bear market of Cycle or larger degree). Factoring in the influence of social mood will give a better picture of how the 2012 GOP Primary is likely to progress.

Sarah Palin isn't in the 2012 GOP race. Of the GOP candidates that have a viable chance of getting the nomination, Mitt Romney is clearly a centrist candidate, Newt Gingrich and Ron Paul are semi-radical candidates, thus making them a decent proxy of Sarah Palin, while Michele Bachmann and Rick Perry are radical candidates, making them an excellent proxy of Sarah Palin.

Currently, we are in the early stages of Primary wave [3] down, just over 7 months so far out of a projected duration of 58 months. Even in 2012, as we go deeper into Primary wave [3] down, social mood may be too bullish for either Michele Bachmann or Rick Perry to with the GOP nomination. A more likely scenario as we go through the heart of Intermediate wave (1) of Primary wave [3] down, is that a semi-radical candidate will have a much better shot at the nomination -- which would favor Newt Gingrich and Ron Paul.

Here is a chart of the DJIA in 2012 with the 2012 GOP Primary elections labelled on the chart:

Here is a step by step walkthrough on how the 2012 GOP Primary could unfold:

Initial wave of states : Iowa, New Hampshire, South Carolina, Florida, and Nevada

Nate Silver rated Iowa and South Carolina as winnable for Sarah Palin, but also indicated that New Hampshire and Nevada would likely go to Mitt Romney.

Iowa is the first state to cast its vote in the 2012 GOP Primary. Iowa holds a caucus rather than a primary. The Iowa caucus takes place as we reach the peak of Minor wave 2 up. While Minor wave 2 up is unfolding, Mitt Romney will have the wind at his back. Although Iowa tends to turn out conservative voters in its caucus, Mitt Romney could perform surprisingly well with up to 25% of the vote. Look for Newt Gingrich, Ron Paul, and Mitt Romney to put in competitive numbers in the Iowa caucus with all three winning delegates.

New Hampshire is the second state in the GOP Primary. New Hampshire tends to favor centrist candidates, which will give Mitt Romney a substantial advantage. Minor wave 3 down will already be under way when New Hampshire holds its primary. However, Minor wave 3 down is expected to be in its early stages (about half way through Minute wave [i] of Minor wave 3 down) so Mitt Romney will still be able to win the state by a sizable margin even though he will no longer have the wind at his back.

South Carolina would be next after New Hampshire. South Carolina tends to favor conservative candidates. We will be almost a month into Minor wave 3 down with its first subwave almost completed when South Carolina holds its primary. Look for Mitt Romney to put in a weak performance with Newt Gingrich and Ron Paul each picking up 35% to 40% of the vote.

Florida holds its primary at the end of January 2012. Nate Silver rated Florida as below average for Sarah Palin, and its reasonable that it would be below average for Newt Gingrich and Ron Paul as well. We will have completed Minute wave [i] of Minor wave 3 down at this point, so a bearish social mood will almost certainly counter most of the advantage that Mitt Romney would otherwise have. Although Mitt Romney could win the state, look for Newt Gingrich and Ron Paul to put in competitive numbers.

Nevada is the last of the states in the early phase of the 2012 GOP Primary. Nevada plays very strongly to Mitt Romney's advantage. We will be in Minute wave [ii] of Minor wave 3 down. The rising social mood associated with Minute wave [ii] could (at least temporarily) give Mitt Romney a wind at his back. Look for Mitt Romney to win Nevada by a big margin.

Second wave of states -- Montana, Idaho, Wyoming, Alaska, Maine, Nebraska, North Dakota, South Dakota, New Mexico, Hawaii, Delaware, Rhode Island, Vermont, and West Virginia

Nate Silver's analysis back in 2009 indicated that if Sarah Palin can survive the initial wave of states, the second wave of states would be very strong for her. However, the second wave of states also tends to award organizational strength as well, which would be most advantageous to Mitt Romney. The 2012 GOP Primary should be a three man race at this point with Mitt Romney, Newt Gingrich, and Ron Paul vying for the nomination. We will be in the first half of Minute wave [iii] of Minor wave 3 down during this period. Mitt Romney should find success in the early part of this period, but success will get progressively more difficult as we approach the center of Minor wave 3 down. Look for Mitt Romney to win around a third of the states.

Super Tuesday -- Texas Group of states

The later wave of states unfold in three phases with Super Tuesday being the first phase, the second phase unfolding from late March 2012 to early May 2012, and the third phase from mid May 2012 to mid June 2012. The Texas group was rated as good for Sarah Palin's nomination chances (and thus would be an advantage to Newt Gingrich and Ron Paul as well) while the California group and the Pennsylvania group both confer an advantage to Mitt Romney under normal conditions.

By the time Super Tuesday comes around, we will have passed through the center of Minor wave 3 down, triggering an Intermediate degree point of recognition in a bear market. The result will be the "Panic of 2012" with the Obama Administration launching TARP 2 to bail out the banks. In the aftermath of the Intermediate degree point of recognition, the political winds will shift back in the direction of the Republicans, and even within the GOP, the political winds will shift strongly in favor of increasingly radical candidates. This is where Mitt Romney will reach the end of the road as a combination of bearish social mood and the Texas group being advantageous to conservatives will be too much to overcome. Expect Mitt Romney to drop out of the race in the aftermath of a painfully disappointing performance on Super Tuesday.

Pennsylvania Group of states

This phase of the 2012 GOP Primary will unfold during Minute waves [iv] and [v] of Minor wave 3 down. It will be a two man race at this point with Newt Gingrich and Ron Paul battling it out for the nomination. By the end of this period, it should be clear who the Republican nominee will be, depending on how evenly matched the two candidates are against each other

California Group of states

The last phase of the 2012 GOP Primary unfolds during Minor wave 4 up. If the two candidates are evenly matched against each other, we may get a scenario where nobody gets the required number of delegates needed to win the Republican nomination. Endorsements will be key in the last phase of the race if the contest is close.

We are currently in the final part of Minor wave 2 up. Mitt Romney will have the wind at his back for the rest of the year and for the first few days of January 2012. The mainstream media is already convinced that Mitt Romney will win the Republican nomination. By the end of Minor wave 2 up, Mitt Romney will have moved back into first place in all the polls. Once Minor wave 3 down starts unfolding, success will become increasingly difficult for Mitt Romney as the bearish social mood brings out the voter tendency to pick increasingly radical candidates.

Sunday, December 4, 2011

Aura of Exuberant Bullishness

We are definitely in the last part of Minor wave 2 up, and it shows in the form of exuberant bullishness. Virtually everyone is bullish on the stock market, economy, and the job market. Economists, market analysts, and people in the mainstream media are extremely bullish on the economy and the job market.

The massive shift to exuberant bullishness occurred on Wednesday with the intervention of multiple central banks with the aim of shoring up liquidity. The DJIA shot up almost 500 points on that day. The Federal Reserve, the Bank of England, the Bank of Canada, the Bank of Japan, and the European Central Bank all joined in a coordinated move to shore up liquidity in the financial markets. The move also made more dollars available at a cheaper rate. The event resulted in exuberant bullishness with economists and market analysts expressing optimism that the sovereign debt crisis in Europe will be solved once and for all.

The US jobs report came out on Friday. The DJIA, S&P 500, and the Wilshire 500 were virtually flat for the day, rallying in the early hours before giving it all back by the end of the trading session. The job report showed that the "official unemployment rate" (U-3) fell from 9.0% to 8.6% even though job creation remained sluggish. Even before the report came out, economists were already extremely bullish on the job market. Once the job report came out, an aura of exuberant bullishness commenced as even the mainstream media turned extremely bullish on the job market.

The DJIA shot up over 800 points for the week. Virtually everyone is convinced that the stock market will keep rising and are calling for more bull market. Many are even calling for the DJIA and the S&P 500 to exceed their 2007 highs.

There is a pervasive aura of exuberant bullishness in force. This is consistent with the wave personality of a wave 2 in a bear market as analysts, economists, and investors become convinced that the worst is over as calls for more bull market and calls for more economic recovery become louder. We are approaching the end of Minor wave 2 up, with Minor wave 3 down to follow starting in January 2012.

Just like May 2011 when the peak of Primary wave [2] up (2009 - 2011) was reached, President Obama is already declaring victory on the economy and has put up the "Mission Accomplished" sign on the job market.

Aside from the economy, job market, and the stock market, there are two other socionomic indicators that are also signalling that were are in the last part of Minor wave 2 up:

1 -- Occupy Wall Street continues to follow the same pattern as the Tea Party. Recall that the Tea Party was rapidly losing steam with fewer and fewer rallies and protests in the streets as Intermediate wave (C) of Primary wave [2] up unfolded. The same pattern is unfolding with OWS as protests in the streets have rapidly declined since late November 2011 when Minute wave [y] of Minor wave 2 up started. As of today, as I write this, OWS protests have virtually stopped in the United States. The Tea Party was characterized as a "spent force" and a "flash in the pan" by the time we reached the peak of Primary wave [2] up. There is expectation that the mainstream media will characterize OWS as a "flash in the pan" by the time we reach the peak of Minor wave 2 up. We are getting close to that point (perhaps 1 to 4 weeks in the future) but there are already a handful of bloggers making comments about OWS getting exhausted, such as this one that appeared on CNBC.

2 -- Virtually everyone in the mainstream media is strongly convinced that Mitt Romney will be the Republican nominee. This trend was easily predictable using the socionomic model as voters have a tendency to vote for centrist candidates as social mood becomes increasingly bullish and radical candidates as social mood becomes increasingly bearish. Intrade was giving Mitt Romney as much as a 70% chance of winning the Republican Primary. While Minor wave 2 up is unfolding, Mitt Romney will have the wind at his back in the Republican Primary. Once Minor wave 3 down starts in January 2012, Mitt Romney will face increasingly stiff headwinds as the voter tendency to vote for radical candidates increases over time.

We will be facing increasingly hard times in 2012 as we go deeper into Primary wave [3] down. For now, there is an aura of exuberant bullishness that is expected to persist through the holidays. The job market is having its last gasp as the creation of jobs reflects hiring in anticipation of Black Friday and the holiday shopping season.

The massive shift to exuberant bullishness occurred on Wednesday with the intervention of multiple central banks with the aim of shoring up liquidity. The DJIA shot up almost 500 points on that day. The Federal Reserve, the Bank of England, the Bank of Canada, the Bank of Japan, and the European Central Bank all joined in a coordinated move to shore up liquidity in the financial markets. The move also made more dollars available at a cheaper rate. The event resulted in exuberant bullishness with economists and market analysts expressing optimism that the sovereign debt crisis in Europe will be solved once and for all.

The US jobs report came out on Friday. The DJIA, S&P 500, and the Wilshire 500 were virtually flat for the day, rallying in the early hours before giving it all back by the end of the trading session. The job report showed that the "official unemployment rate" (U-3) fell from 9.0% to 8.6% even though job creation remained sluggish. Even before the report came out, economists were already extremely bullish on the job market. Once the job report came out, an aura of exuberant bullishness commenced as even the mainstream media turned extremely bullish on the job market.

The DJIA shot up over 800 points for the week. Virtually everyone is convinced that the stock market will keep rising and are calling for more bull market. Many are even calling for the DJIA and the S&P 500 to exceed their 2007 highs.

There is a pervasive aura of exuberant bullishness in force. This is consistent with the wave personality of a wave 2 in a bear market as analysts, economists, and investors become convinced that the worst is over as calls for more bull market and calls for more economic recovery become louder. We are approaching the end of Minor wave 2 up, with Minor wave 3 down to follow starting in January 2012.

Just like May 2011 when the peak of Primary wave [2] up (2009 - 2011) was reached, President Obama is already declaring victory on the economy and has put up the "Mission Accomplished" sign on the job market.

Aside from the economy, job market, and the stock market, there are two other socionomic indicators that are also signalling that were are in the last part of Minor wave 2 up:

1 -- Occupy Wall Street continues to follow the same pattern as the Tea Party. Recall that the Tea Party was rapidly losing steam with fewer and fewer rallies and protests in the streets as Intermediate wave (C) of Primary wave [2] up unfolded. The same pattern is unfolding with OWS as protests in the streets have rapidly declined since late November 2011 when Minute wave [y] of Minor wave 2 up started. As of today, as I write this, OWS protests have virtually stopped in the United States. The Tea Party was characterized as a "spent force" and a "flash in the pan" by the time we reached the peak of Primary wave [2] up. There is expectation that the mainstream media will characterize OWS as a "flash in the pan" by the time we reach the peak of Minor wave 2 up. We are getting close to that point (perhaps 1 to 4 weeks in the future) but there are already a handful of bloggers making comments about OWS getting exhausted, such as this one that appeared on CNBC.

2 -- Virtually everyone in the mainstream media is strongly convinced that Mitt Romney will be the Republican nominee. This trend was easily predictable using the socionomic model as voters have a tendency to vote for centrist candidates as social mood becomes increasingly bullish and radical candidates as social mood becomes increasingly bearish. Intrade was giving Mitt Romney as much as a 70% chance of winning the Republican Primary. While Minor wave 2 up is unfolding, Mitt Romney will have the wind at his back in the Republican Primary. Once Minor wave 3 down starts in January 2012, Mitt Romney will face increasingly stiff headwinds as the voter tendency to vote for radical candidates increases over time.

We will be facing increasingly hard times in 2012 as we go deeper into Primary wave [3] down. For now, there is an aura of exuberant bullishness that is expected to persist through the holidays. The job market is having its last gasp as the creation of jobs reflects hiring in anticipation of Black Friday and the holiday shopping season.

Subscribe to:

Posts (Atom)